Comprehensive Credit Facilities in United Arab Emirates – Loans, Financing, and Insurance Options

Explore Flexible Credit Facilities in United Arab Emirates – Business Loans, Car Financing, Mortgages & More

Our credit facilities in United Arab Emirates offer a variety of loan and financing solutions designed to meet your unique financial needs. Whether you need a business loan, car financing, a personal loan, or mortgage options, we provide flexible terms, competitive interest rates, and quick approval processes to ensure you get the financial support you require.

Our Credit Facilities Include:

- Business Loans: Secure the capital you need to start or grow your business with our flexible business loan options. We offer financing for various business purposes, including expansion, equipment purchase, and working capital.

- Car Financing: Whether you're buying a new or used car, our car financing options in United Arab Emirates offer affordable interest rates and flexible repayment terms to make car ownership accessible.

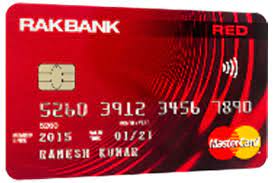

- Credit Cards: Access a wide range of credit card options, from rewards programs to low-interest rate cards, providing you with a convenient way to manage your everyday expenses and build credit.

- Credit Insurance: Protect your financial wellbeing with credit insurance. Whether you're taking out a loan or applying for a credit card, our credit insurance options offer peace of mind in case of unforeseen events.

- Home Loans: Our home loan services in United Arab Emirates offer competitive rates for purchasing or refinancing your home. We help make homeownership a reality with flexible terms and expert guidance.

- Mortgages: Get the mortgage you need with our range of mortgage products. Whether you're a first-time homebuyer or refinancing an existing mortgage, we offer options to suit your financial situation.

- Personal Loans: Access personal loans for various needs, including debt consolidation, home improvement, or major purchases. Our personal loans come with flexible terms and competitive rates.

Why Choose Our Credit Facilities in United Arab Emirates?

- Quick and Easy Application Process: Our simple application process ensures that you can quickly apply for credit facilities online. Receive fast approval and access your funds sooner.

- Customizable Loan Terms: We offer flexible terms for all our credit facilities, including adjustable repayment schedules and loan amounts tailored to your specific needs.

- Competitive Interest Rates: Our credit facilities are offered with competitive rates, helping you save money over the course of the loan and ensuring that your monthly payments remain affordable.

- No Hidden Fees: Transparency is our priority. There are no hidden fees or surprise costs – you’ll always know exactly what to expect when you take out a loan or apply for credit.

- Expert Financial Guidance: Our team of financial experts is ready to help you navigate the loan and financing process, providing advice to ensure you make the best financial decisions.

Additional Benefits of Our Credit Facilities in United Arab Emirates:

- Quick Loan Disbursement: Once your application is approved, funds are disbursed quickly, so you can meet your financial needs without unnecessary delays.

- Access to Multiple Financing Options: Whether you need a business loan, a car loan, or a mortgage, our diverse range of credit facilities ensures that all your financial needs are covered.

- Enhanced Credit Opportunities: By utilizing our credit facilities, you can build or improve your credit score, allowing for future financial opportunities at better terms.

- Support for Any Financial Goal: Whether you're buying a car, starting a business, or consolidating debt, our credit facilities are designed to help you achieve your personal or business goals.

Explore our range of credit facilities in United Arab Emirates today. Contact us to learn more about the financing options available to you, or apply online for fast approval and competitive rates.

Post ad

Post ad